OVERDRAFT KINDNESS

Account balance go negative? We've got your back.

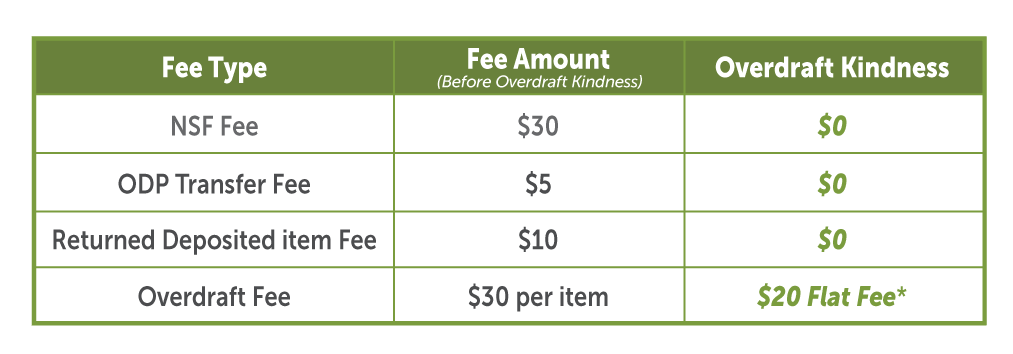

When an overdraft occurs, Columbia CU’s Overdraft Kindness allows you to avoid a potential one-time $20 fee for the day a transaction took your account negative if your account is brought positive by 6:30 pm on the day of that overdraft.

Ways to bring your account positive:

- Make a Deposit – Deposit funds in a branch or ATM, or make a mobile deposit with the app or a business remote deposit; make a same-day ACH

- Make a Transfer – Transfer funds from another account in a branch or with the app; phone-a-friend for a Pay People member-to-member transfer