High-Yield Checking

Checking

Checking Accounts

FREE CHECKING ACCOUNTS

Your money, your way.

Say goodbye to monthly fees and hello to hassle-free banking. Choose from one of three great accounts tailored to fit your unique lifestyle.

Discover a world of unique benefits.

No Fees

We won't charge you a monthly fee so you can keep more of your hard-earned money.

Great Perks

Enjoy a wide range of perks and benefits with each of our three feature-rich accounts.

$1 to Open

A single dollar is all it takes to open an account and experience smarter banking.

Each month, earn 5.50% APY1 on balances up to $25,000 and receive up to $25 in nationwide ATM fee rebates when 3 easy steps are completed during that month’s Requirements Period (26th of the prior month – 25th of the current month).

- Requirements to earn 5.50% APY and ATM refunds:

- Make at least 15 purchases using a combination of your Columbia CU debit card(s) and credit card(s)

- Have a direct deposit of at least $500 into your Income Checking

- Enroll in e-statements

- If you don’t meet the qualification requirements, you will earn 0.05% on your balance and ATM fees will not be reimbursed.

Features include:

- No monthly fee or minimum balance requirements

- No Columbia CU ATM fee

- Free Online and Mobile Banking, debit rewards, budgeting tool, and e-statements

- $1 minimum to open

- Available with Stash Your Cash

- Direct Deposit

Upgrade to a checking account packed with many perks and benefits. Take advantage of free money orders, free checks, and much more.

Enjoy the following benefits:

- One free folio of Columbia CU checks per year

- Free unlimited money orders

- 25% discount on safe deposit box rental

- No monthly fee or minimum balance requirements

- Free Online and Mobile Banking, debit rewards, budgeting tool, and e-statements

- No ATM fee for using Columbia machines

- $1 Minimum to open

- Available with Stash Your Cash

- Direct Deposit

A free checking account for kids up to age 18. Robust parental controls allow you to monitor and manage their account.

Here are the details:

- A parent or guardian must be a co-holder of the account

- Free standard or custom-design debit card

- Free online & mobile banking, budgeting tools, debit rewards, and e-statements

- No monthly fee

- No minimum balance

- No overdrafts

- Lower limits for (unlimited) ATM withdrawals

- $1 minimum to open

- Automatically converts to Income Checking when child turns 18

- Your kid is in charge: They can withdraw and deposit funds on their own

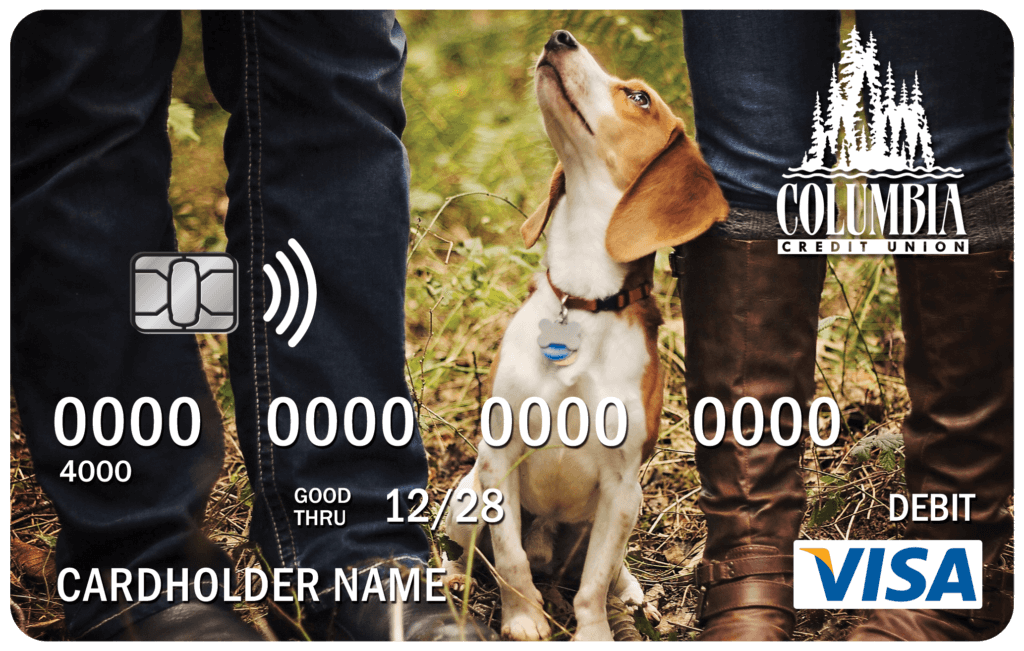

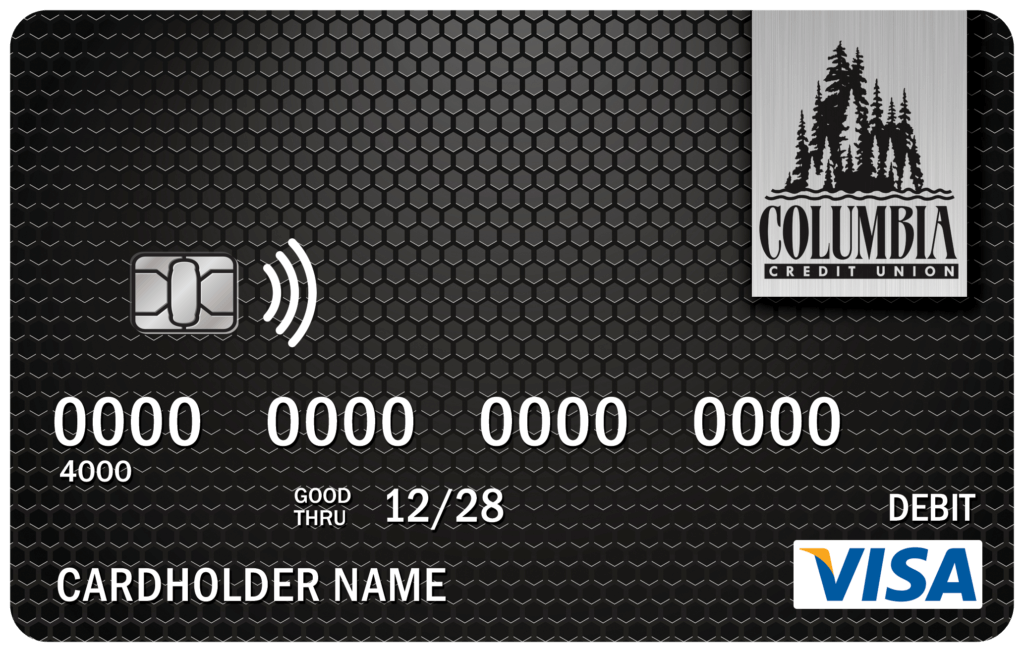

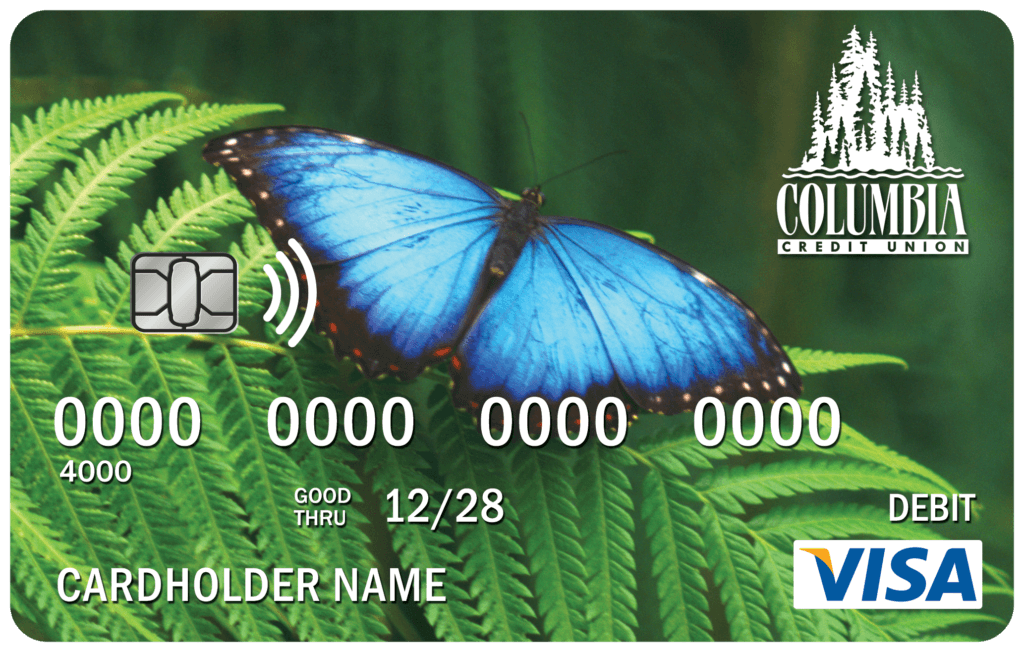

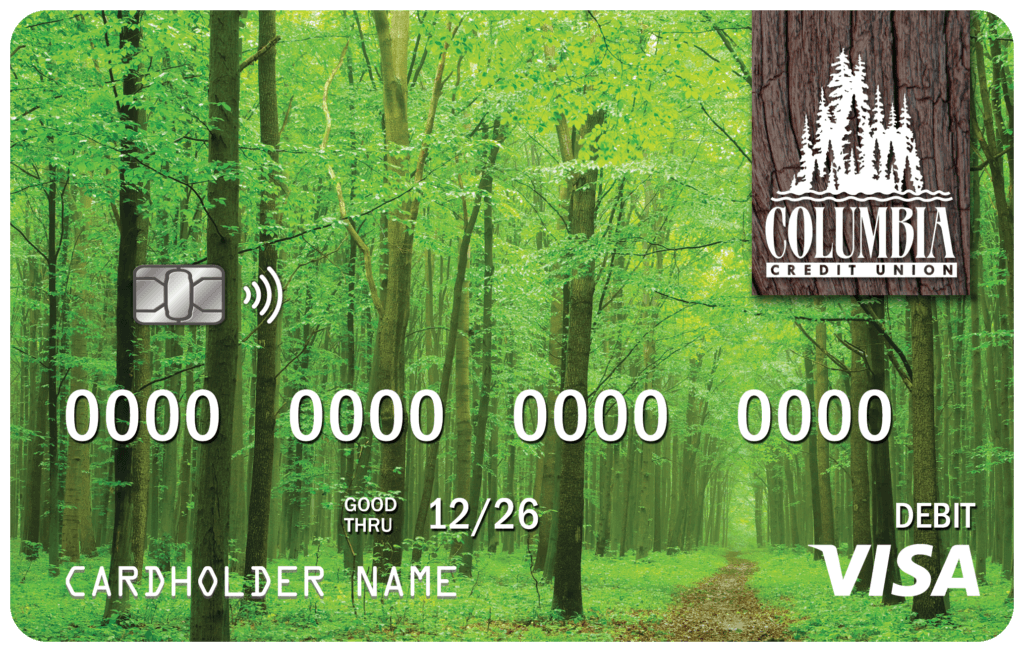

Personalize your card.

Pick the design you like best or upload your own custom image for free to make your debit card as one-of-a-kind as you.

Debit Card Features

Our Card Manager feature in Online & Mobile Banking helps secure your cards while you’re away from home.

Overdraft Protection

Have peace of mind knowing you won’t get hit with annoying fees if you make a purchase that exceeds your balance.

Here’s how it works:

- Columbia CU will transfer funds in increments of $100 from your linked accounts.

- If the full $100 is not available in your linked accounts but there is enough to cover the overdraft, that amount will be transferred to cover the overdraft.

- Overdraft Kindness allows you to avoid a $20 fee for a negative balance. Simply make your account positive again by 6:30 PM on that same day.

- Link to your Savings Account, Money Market Account, Checking Account, Personal Line of Credit, or all four.

Call 360.891.4000, visit a branch, or use the Digital Assistant to get started.

Overdraft Protection

Have peace of mind knowing you won’t get hit with annoying fees if you make a purchase that exceeds your balance.

Here’s how it works:

- Columbia CU will transfer funds in increments of $100 from your linked accounts.

- If the full $100 is not available in your linked accounts but there is enough to cover the overdraft, that amount will be transferred to cover the overdraft.

- Overdraft Kindness allows you to avoid a $20 fee for a negative balance. Simply make your account positive again by 6:30 PM on that same day.

- Link to your Savings Account, Money Market Account, Checking Account, Personal Line of Credit, or all four.

Call 360.891.4000, visit a branch, or use the Digital Assistant to get started.

Direct Deposit

Get paid up to three days earlier² than you would with your regularly scheduled payments. Set it and forget it—your money arrives without lifting a finger.

Features include:

- Convenient and secure way to receive your pay

- Avoid waiting in lines or paying fees for paper checks

- Use our highly-rated mobile app or secure online portal to set up direct deposit easily

- Never worry about lost or stolen checks again

Take the hassle out of driving to the credit union to deposit your paycheck. Sign up for direct deposit today and enjoy early access to your funds!

Direct Deposit

Get paid up to three days earlier² than you would with your regularly scheduled payments. Set it and forget it—your money arrives without lifting a finger.

Features include:

- Convenient and secure way to receive your pay

- Avoid waiting in lines or paying fees for paper checks

- Use our highly-rated mobile app or secure online portal to set up direct deposit easily

- Never worry about lost or stolen checks again

Take the hassle out of driving to the credit union to deposit your paycheck. Sign up for direct deposit today and enjoy early access to your funds!

Discretionary Courtesy Pay

Swipe your debit card without fear of being declined at the point of purchase.

Here are the details:

- It’s free to sign up

- Discretionary Courtesy Pay is not a loan

- We will cover you up to a predetermined limit.

- Comes automatically for purchases made by check or through an automatic clearing house.

- Columbia CU will cover your debit card purchase when you have insufficient funds. You need to opt-in to take advantage of this service.

Shop confidently knowing your purchases get automatic protection even when your balance is low.

Click below to learn more and opt-in.

Discretionary Courtesy Pay

Swipe your debit card without fear of being declined at the point of purchase.

Here are the details:

- It’s free to sign up

- Discretionary courtesy pay is not a loan

- We will cover you up to a predetermined limit.

- Comes automatically for purchases made by check or through an automatic clearing house.

- Columbia CU will cover your debit card purchase when you have insufficient funds. You need to opt-in to take advantage of this service.

Shop confidently, knowing your purchases get automatic protection even when your balance is low.

Click below to learn more and opt-in.

Purchase Rewards

Unlocking your debit card rewards is the easiest way to earn cash back from your favorite stores and restaurants. Just click in to your Purchase Rewards portal in Digital Banking.

- Find your favorite merchants and start earning on your purchases

- No limits means the more you use your debit card, the more you earn

Completely secure—your info is never shared with merchants

Purchase Rewards

Unlocking your debit card rewards is the easiest way to earn cash back from your favorite stores and restaurants. Just click in to your Purchase Rewards portal in Digital Banking.

- Find your favorite merchants and start earning on your purchases

- No limits means the more you use your debit card, the more you earn

Completely secure—your info is never shared with merchants

★★★★★

“The service here is always great. Great energy, great connections. They truly care about your membership here and are always willing to find ways to make dealing with your finances easier and less stressful.”

- Sumeja R.

$50 FOR YOU! $50 FOR THEM!

Refer a Friend for $50

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $50 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

$50 FOR YOU! $50 FOR THEM!

Refer a Friend for $50

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $50 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

More popular account options

Holiday Club Savings

Eliminate holiday season stress by saving throughout the year, earning interest on your savings, and accessing your funds right when you need them for holiday shopping. This year, make saving a breeze!

Youth Savings Accounts

Help your kids learn the importance of saving with our Achiever’s Club Savings account. Featuring competitive rates and no monthly fees, this account is designed to cultivate money-savvy habits in children.

IRAs

Our IRAs can help you prepare for retirement or fund your child’s college education. With tax advantages and flexible options, preparing for the future has never been easier! Start saving today to secure your financial future.

¹APY=Annual Percentage Yield is accurate as of June 1, 2024, and can change at any time without notice. When qualifications are met, the Rewards Dividend Rate is calculated and accrued daily on ending balances of $25,000 or less. Dividends are paid and compounded monthly. The advertised Rewards APY assumes your balance including the prior months’ dividends, is $25,000 or less every day of every month during the APY’s annual look-ahead timeframe. Minimum to open is $1. Requirements Period: (26th of the prior month – 25th of the current month). To earn Rewards APY and/or ATM fee rebates you must complete these three Requirements during the month’s Requirements Period: 1) Be enrolled in e-Statements; 2) Have a direct deposit of at least $500 into Income Checking; 3) Have 15 posted* Income Checking debit card or Columbia CU credit card purchases; pending transactions do not qualify. Please Note: Debit and credit card transactions may not post (or may show as pending, not posted) to your Income Checking or Credit Card Account the same day as the purchases. *Definition: posted transaction has fully processed and appears on your account statement or in online & mobile banking with a transaction date. Credit card purchases count toward Requirements when the same person is the Tax Reported Owner (member) on the Income Checking and the credit card account. ATM withdrawals don’t count toward Requirements. Limit one (1) Income Checking per Tax Reported Owner (Member).

2Early direct deposit is available for checking members that set up direct deposit with their employer or other payer to receive electronic deposits of regular periodic payments (such as salary, pension, or government benefits). Early direct deposits may be available to you up to 3 days earlier, however, we are dependent on the timing of your payer’s payment and therefore you may not always see your direct deposits arrive early.