SPEND CHECKING

Start their financial journey on the right foot

It’s never too early for real-world money experience. Give your child the gift of a financial know-how.

It’s never too early for real-world money experience. Give your child the gift of a financial know-how.

It’s never too early for real-world money experience. Give your child the gift of a financial know-how.

Teach your kid about money management and financial responsibility from an early age.

No monthly fees means your child keeps more money in their account for savings or fun.

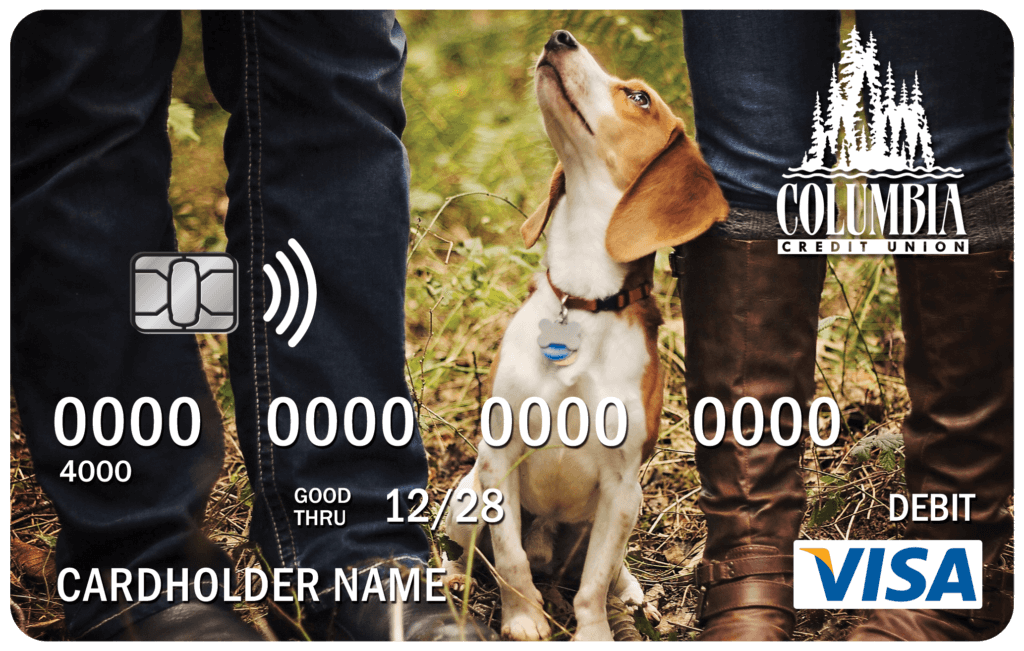

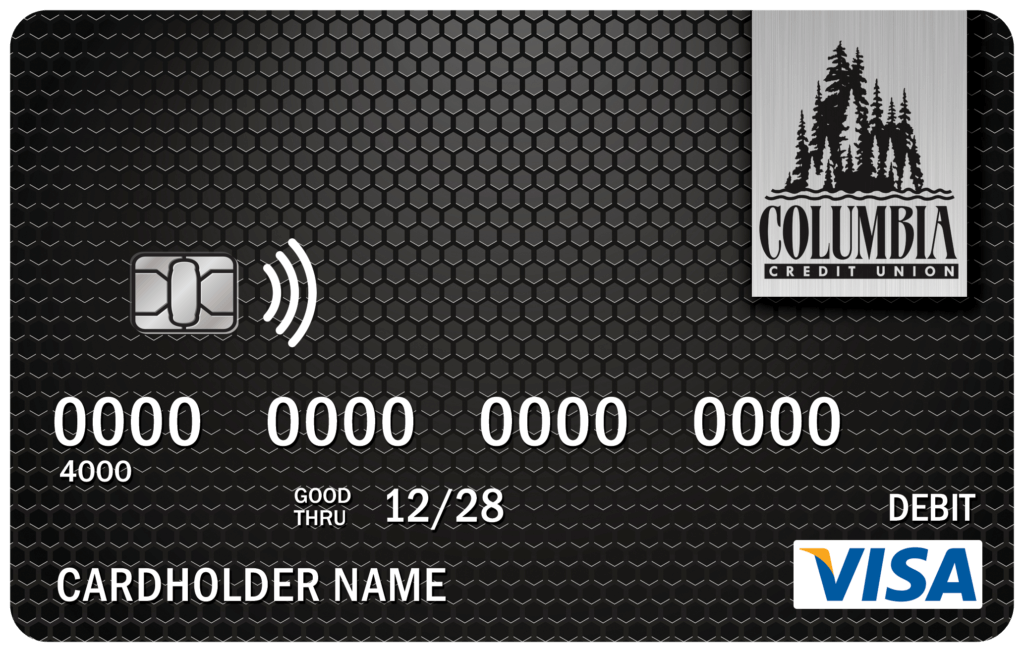

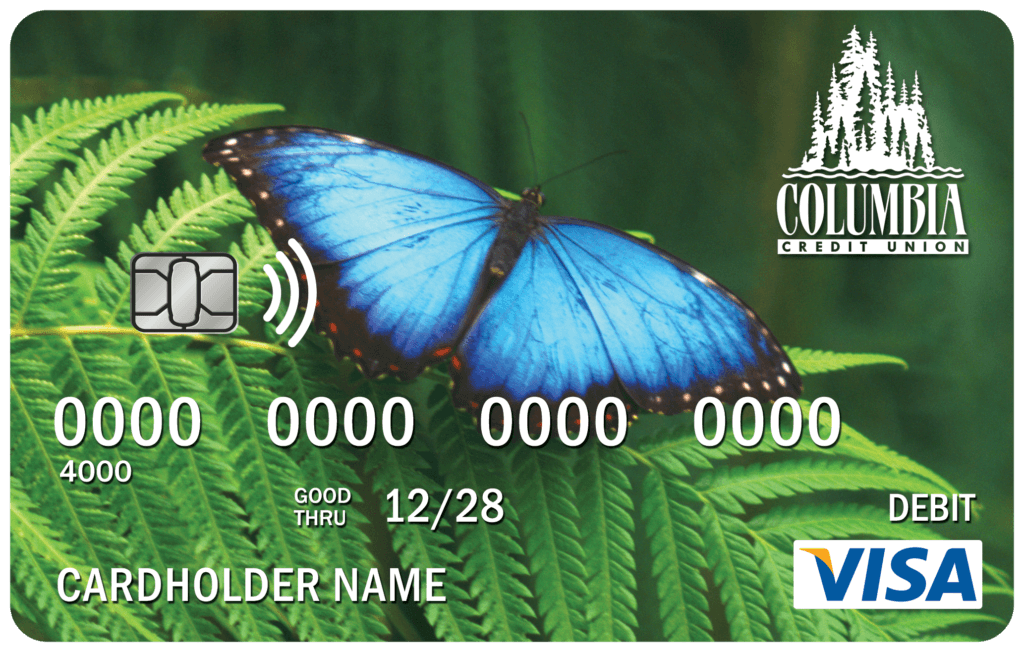

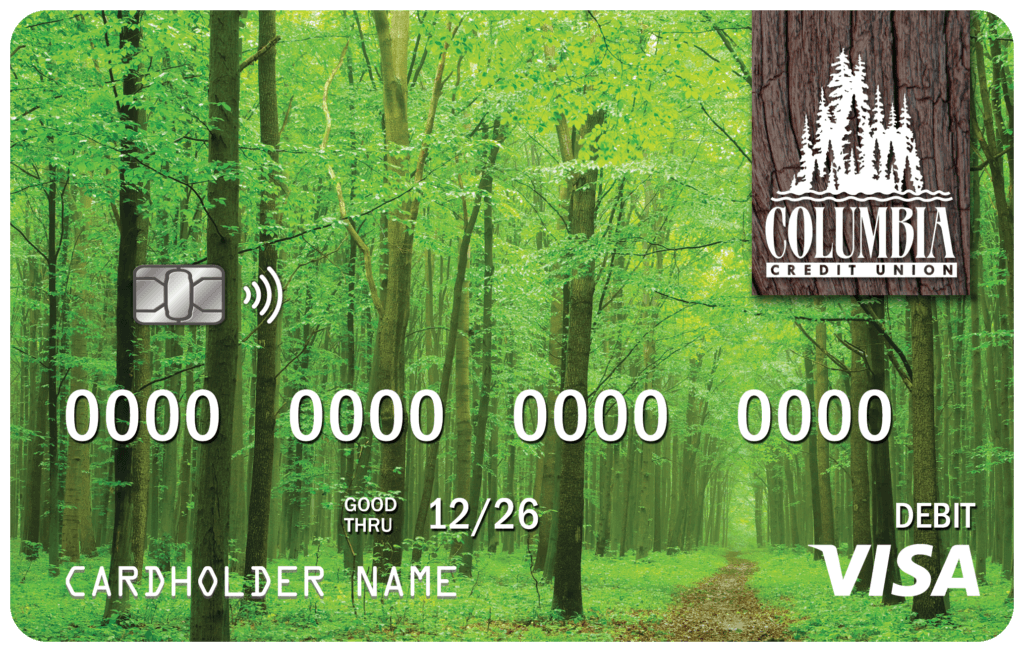

We'll give them a free standard or custom-design debit card with their checking account.

The Spend Checking Account opens the door to smart money management for kids and youth up to age 18. With our robust parental controls, children, teens, and their parents or guardians can actively manage this account together.

Spend Checking gives your child a practical, hands-on approach to money management. This account simplifies financial learning in a fun and engaging way!

The Spend Checking Account opens the door to smart money management for kids and youth up to age 18. With our robust parental controls, children, teens, and their parents or guardians can actively manage this account together.

Spend Checking gives your child a practical, hands-on approach to money management. This account simplifies financial learning in a fun and engaging way!

Use Fern with your kids to incentivize tasks and chores, reward good grades, and more—all while teaching them about spending, savings, and earning.

Fern links to your child’s account so they can:

Register for Fern in Online Banking and the Columbia CU app.

Use Fern with your kids to incentivize tasks and chores, reward good grades, and more—all while teaching them about spending, savings, and earning.

Fern links to your child’s account so they can:

Register for Fern in Online Banking and the Columbia CU app.

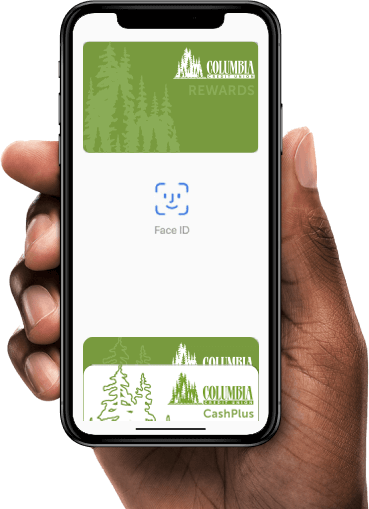

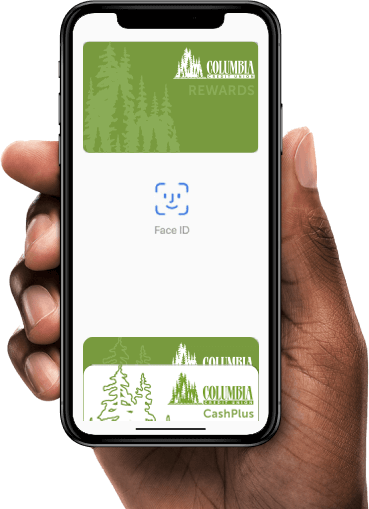

Experience the convenience and security of our Mobile Wallet service. Simply add your Columbia Credit Union debit or credit card to your device’s Apple Pay, Google Pay, or Samsung Pay app.

Make purchases in stores and within apps without swiping your cards or entering payment and contact information. Rest assured that merchants will never see your personal details or contact info.

Experience the convenience and security of our Mobile Wallet service. Simply add your Columbia Credit Union debit or credit card to your device’s Apple Pay, Google Pay, or Samsung Pay app.

Make purchases in stores and within apps without swiping your cards or entering payment and contact information. Rest assured that merchants will never see your personal details or contact info.

Use the debit card for direct access to cast at ATMs or banks within our network.

EMV chip technology actively safeguards against fraud and theft with advanced encryption.

Pick the design you like best or upload your own custom image for free to make your debit card as one-of-a-kind as you.

The primary holder must be under 18 to open a Spend Checking Account. However, a parent or guardian must be a co-holder of the account.

No monthly maintenance fees make it a cost-effective option for young users. The account focuses on providing financial education and managing transactions instead of earning interest.

Both accounts offer no monthly fees, minimum balance, and Mobile and Online Banking access. However, they differ in the following ways:

Interest and Requirements: Income Checking earns interest and requires specific card purchases and a direct deposit. Kid’s Checking does not earn interest and does not have these requirements.

ATM Fee Rebates: Income Checking offers monthly ATM fee rebates (conditions apply). Kid’s Checking does not have this feature. However, it does offer unlimited ATM withdrawals with lower limits.

Purpose and Focus: Kid’s Checking teaches young users about money management. Income Checking is geared towards adults, offering direct deposit and ATM rebates for regular income earners and more frequent transactions.

No. They will need an over-18 parent or legal guardian to open an account on their behalf. Once they turn 18, they can take full advantage of all the benefits of being a Columbia Credit Union member.

Visit our dedicated rate page to view our most up-to-date interest rates and APY details across all account types. However, our Spend Checking Account does not earn interest. We designed it as a practical tool for teaching kids about money management.

For all applicants, we require a social security number. For the parent or guardian, we also require a driver’s license, state ID, passport, or military ID.

★★★★★

Teach your kids the value of savings with our Achiever’s Club Savings account. With competitive rates and no monthly fees, it’s the perfect account to start your child on the path to financial independence.

Unlock greater earnings compared to traditional checking or savings accounts, all while keeping your funds readily available. And with our tiered rates, your earnings will grow as your balance increases!

Let your money grow effortlessly with our Income Checking account. With attractive returns, no fees, and ATM rebates, this account is tailored to maximize your money’s potential.