YOUTH SAVINGS ACCOUNTS

Raise a money-savvy kid with our Achiever's Club

Teach your child smart money habits that will last a lifetime. Our Achiever’s Club Savings Account is for anyone 19 and younger.

Teach your child smart money habits that will last a lifetime. Our Achiever’s Club Savings Account is for anyone 19 and younger.

Teach your child smart money habits that will last a lifetime. Our Achiever’s Club Savings Account is for anyone 19 and younger.

Help your child's savings grow faster with interest rates that beat a regular piggy bank.

Their money can flourish without annoying monthly fees reducing it.

Teach your child about money management and financial responsibility from an early age.

Give your child the foundation for smart savings habits and financial success. The Achiever’s Club Savings Account is a powerful tool to build a bright future.

It features:

Open an account today for your child to start them on the path to financial independence.

Give your child the foundation for smart savings habits and financial success. The Achiever’s Club Savings Account is a powerful tool to build a bright future.

It features:

Open an account today for your child to start them on the path to financial independence.

★★★★★

Our Youth Certificate offers tiered rates and a 12-month term. It’s the perfect way to teach kids how to invest!

Our Youth Certificate offers tiered rates and a 12-month term. It’s the perfect way to teach kids how to invest!

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $100 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

Refer a friend to open their first checking account with Columbia CU and we’ll deposit $100 into BOTH of your accounts. Just our way of saying thanks—and welcome! And, a great way for you to share the value offered through Columbia Credit Union membership with your friends and family.

Use Fern with your kids to incentivize tasks and chores, reward good grades, and more—all while teaching them about spending, savings, and earning.

Fern links to your child’s account so they can:

Register for Fern in Online Banking and the Columbia CU app.

Use Fern with your kids to incentivize tasks and chores, reward good grades, and more—all while teaching them about spending, savings, and earning.

Fern links to your child’s account so they can:

Register for Fern in Online Banking and the Columbia CU app.

Yes! You can enroll in digital banking to allow them to check their balance, review transactions, and learn about managing their money independently. They can log into the online portal on the website or through our popular mobile app.

Absolutely! This account is designed to help them save for short-term goals and long-term dreams. Whether it’s a new bike, college expenses, or even their first car, our Youth Savings account and the power of dividends can get them there. It also automatically converts into a Regular Savings account on their 19th birthday.

A Youth Savings account is a powerful tool to help your child learn money management skills. It’s a safe place to deposit money and watch it grow with earned interest. There are no monthly maintenance fees; you can start saving with a small minimum opening deposit.

The key to growing their savings is consistency! Make regular deposits, even small ones. The magic of a savings account for your child is that you earn interest on top of what you save. The earlier you start, the more time the money has to grow!

Yes! If you’re the child, a parent or guardian must be a co-account holder until you’re 18 years old. This is a great way to learn about saving together. They can help you track your progress, set goals, and make smart decisions about your money.

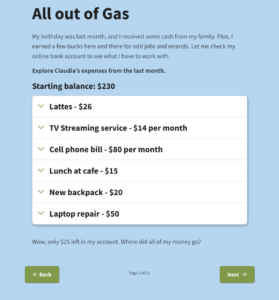

Absolutely! We offer free and easy-to-follow financial education courses designed specifically for youths. Each budgeting, saving, and investing course consists of modules that take roughly 10 minutes to complete.

Here’s what the 2nd step of the “Smart Budgeting” course looks like:

Planning for a worry-free retirement or funding your child’s college education? With our IRAs, you can enjoy tax benefits and flexible withdrawal choices, making it simple to create a secure financial future!

Save all year long, earn dividends to boost your savings, and have funds ready right in time for holiday shopping. Opt for our Holiday Club Savings account for a stress-free holiday season!

Now is the perfect time to start building smart spending habits, and our youth checking account makes it easy. With no monthly fees and a free debit card, it’s an ideal way to teach your kids valuable money management skills.